We Are A Non-Profit Organization That Supports Good Causes And Positive Changes All Over The World.

About Ramagya Foundation (A unit of Purusharth Charitable Society)

Ramagya Foundation works on sustainable improvement, peace, and righteousness towards the actualization of social commitments to unleash and nurture talent. Ramagya Foundation works diligently for Education, Health, Sports Education, Skilling, Women Empowerment, and Animal welfare. The foundation is committed to imparting values and enhancing living standards through our uniquely curated programs to contribute towards the development of an educated society.

This is the story of Simran. She is 7 years old and studies in class 1. She lives with her family in Barola village, Noida. Simran aspires to become singer one day.

- To provide an environment to the most vulnerable sections of society by uplifting them economically, socially, mentally, emotionally and leading them towards rewarding lives.

- To implement sustainable programmes through which every child attains the right to survival, education, participation and development.

- To prepare every eligible youth of India in remotest of areas with a platform to learn and grow.

- To work with communities to end poverty, unemployment and illiteracy.

- We envision a world of dignity and respect for women and girls by imparting skills and providing employment opportunities.

Ramagya Foundation unites the education and skills with efficient stakeholders & respondents to facilitate stronger communities by mobilizing and motivating succeeding generations from economically and socially challenged areas and putting them firmly on the track of quality life.

Stories of Change

Ruby

Jyoti

Our Programs

Glimpse of The Videos

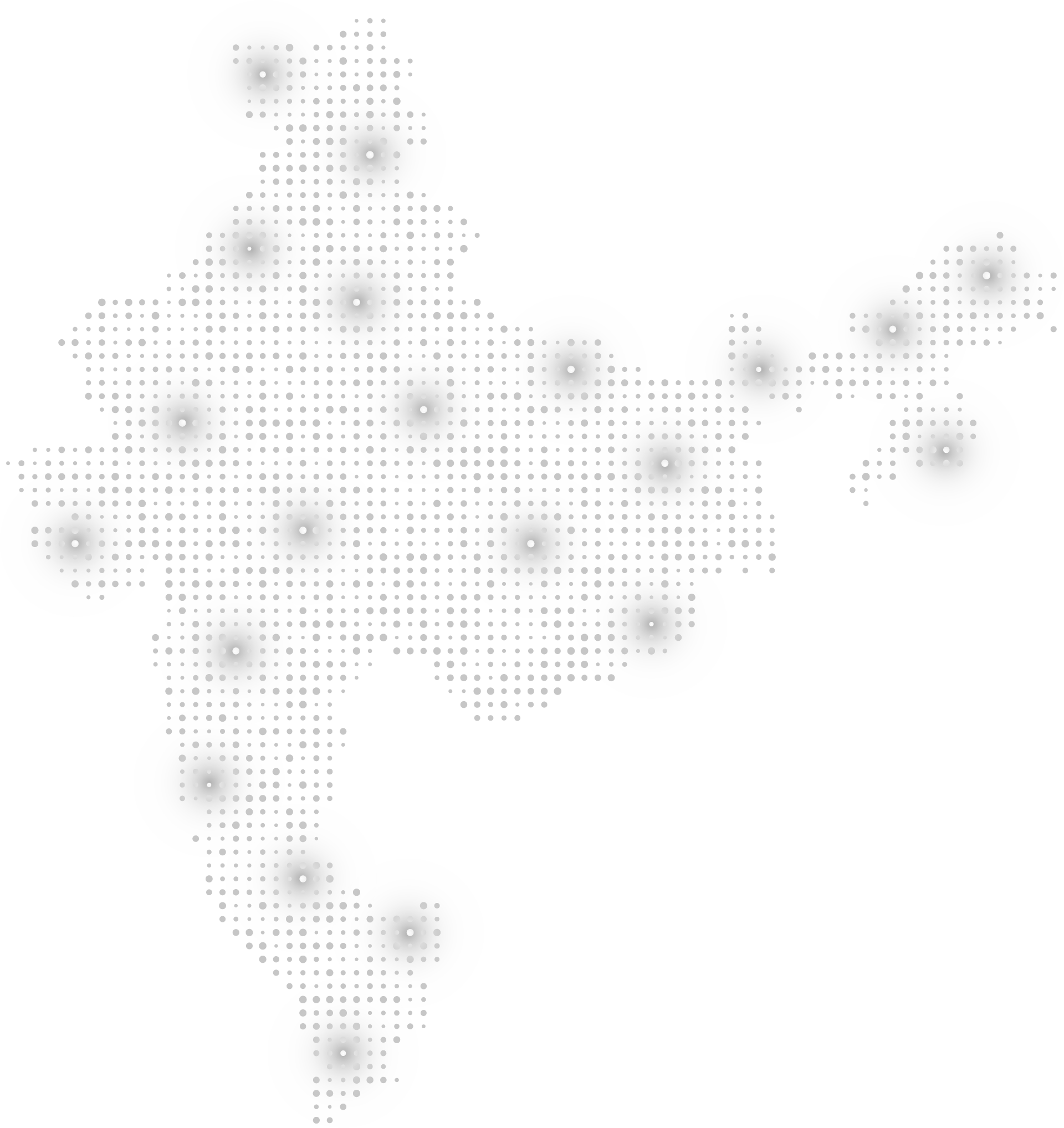

Our Reach So Far

Education

Health

Sports

Animal Welfare

Our Partners

Our CSR Conference Partners

Or, you can deposit directly in the bank. The details are as follows:

Bank Name : Indian Bank

Account No: 6245699506

IFSC Code: IDIB000S153

All Donations to Ramagya Foundation(A unit of Purusharth Charitable Society) are eligible for 50% tax exemption under section 80G of the Income Tax Act.

Anything Else!